In the world of investment, high-quality investment memos play a crucial role in the decision-making process. These documents provide a comprehensive overview of potential investments, including their associated risks and opportunities. However, efficiently creating effective memos has been an ongoing challenge for investment professionals. Recently, AI-powered solutions have emerged, offering new approaches to deal flow management and memo drafting.

The Importance of Investment Memos and the Challenges

Investment memos are the lifeblood of deal flow management. They encapsulate critical information, analysis, and recommendations that guide investment decisions. However, crafting these memos traditionally involves time-consuming research, analysis, and writing – time that could be better spent on high-value activities like relationship building and strategic planning.

Key Point 1: Automated Deck Analysis

In the fast-paced world of investment, time is often the most precious commodity. Enter automated deck analysis – a game-changing approach that's revolutionizing how investors evaluate potential opportunities.

Automated deck analysis leverages artificial intelligence and machine learning algorithms to rapidly process and extract key information from pitch decks. This technology can analyze hundreds of decks in a fraction of the time it would take a human analyst, providing a significant competitive advantage in deal sourcing and evaluation. The insights gleaned from this automated analysis serve as a crucial foundation for creating comprehensive and data-driven investment memos, ensuring that key information from pitch decks is seamlessly incorporated into the decision-making process.

Here's how automated deck analysis is transforming the investment landscape:

1. Rapid Information Extraction

AI-powered tools can quickly scan pitch decks, extracting crucial data points such as market size, revenue projections, and competitive positioning. For instance, DocSend, a document analytics company, reported that VCs spend an average of just 3 minutes and 44 seconds reviewing a pitch deck. Automated analysis ensures no critical information is missed in this brief window.

2. Consistency in Evaluation

By applying the same criteria across all decks, automated analysis ensures a level playing field for all potential investments. This reduces human bias and helps identify promising opportunities that might otherwise be overlooked.

3. Pattern Recognition

Machine learning algorithms can identify patterns across thousands of pitch decks, spotting trends and red flags that human analysts might miss. For example, a leading VC firm in Silicon Valley implemented an automated deck analysis tool that identified a correlation between specific team compositions and startup success rates, leading to more informed investment decisions.

4. Integration with External Data

Advanced automated deck analysis tools can cross-reference information in pitch decks with external data sources, providing a more comprehensive view of the opportunity. This might include market reports, competitor financials, or social media sentiment analysis.

5. Customized Scoring and Ranking

Many automated deck analysis systems allow firms to customize scoring criteria based on their investment thesis. This enables quick prioritization of opportunities that align with the firm's strategy.

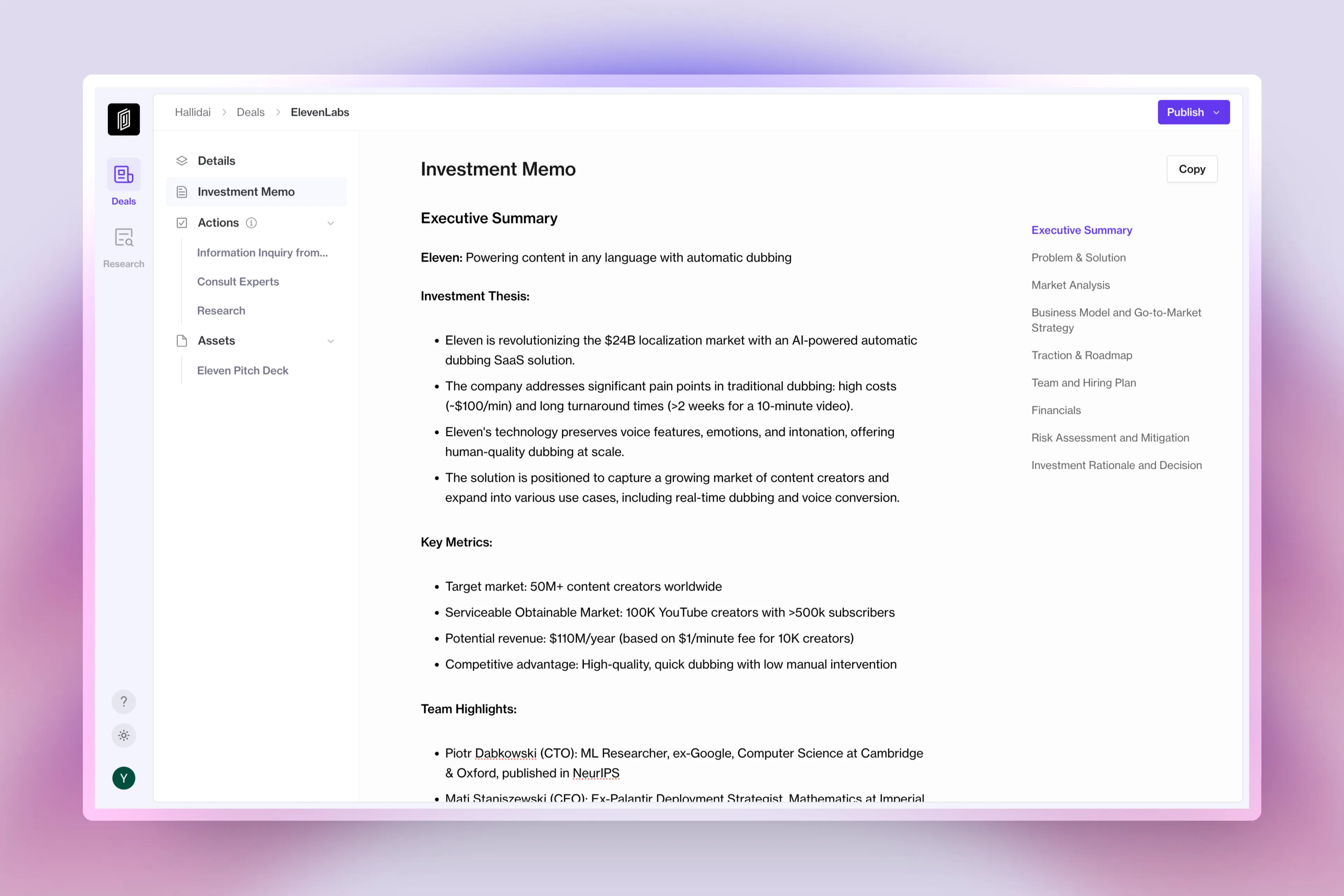

Key Point 2: AI-Assisted Memo Drafting

AI is not just about analysis; it's also revolutionizing the writing process itself. Advanced language models can now generate coherent, well-structured investment memos in a fraction of the time it would take a human analyst.

Case Study: Goldman Sachs' AI Writing Assistant

Goldman Sachs has been at the forefront of implementing AI in their investment processes. In 2021, they introduced an AI writing assistant to help their analysts draft more effective and efficient investment research reports. The tool, developed in partnership with Kensho Technologies, uses natural language processing to analyze vast amounts of financial data and generate coherent, insightful paragraphs for inclusion in reports.

Results from the implementation included:

- A 50% reduction in time spent on initial drafting

- Improved consistency across reports

- Increased analyst productivity, allowing them to cover more companies and produce more in-depth analysis

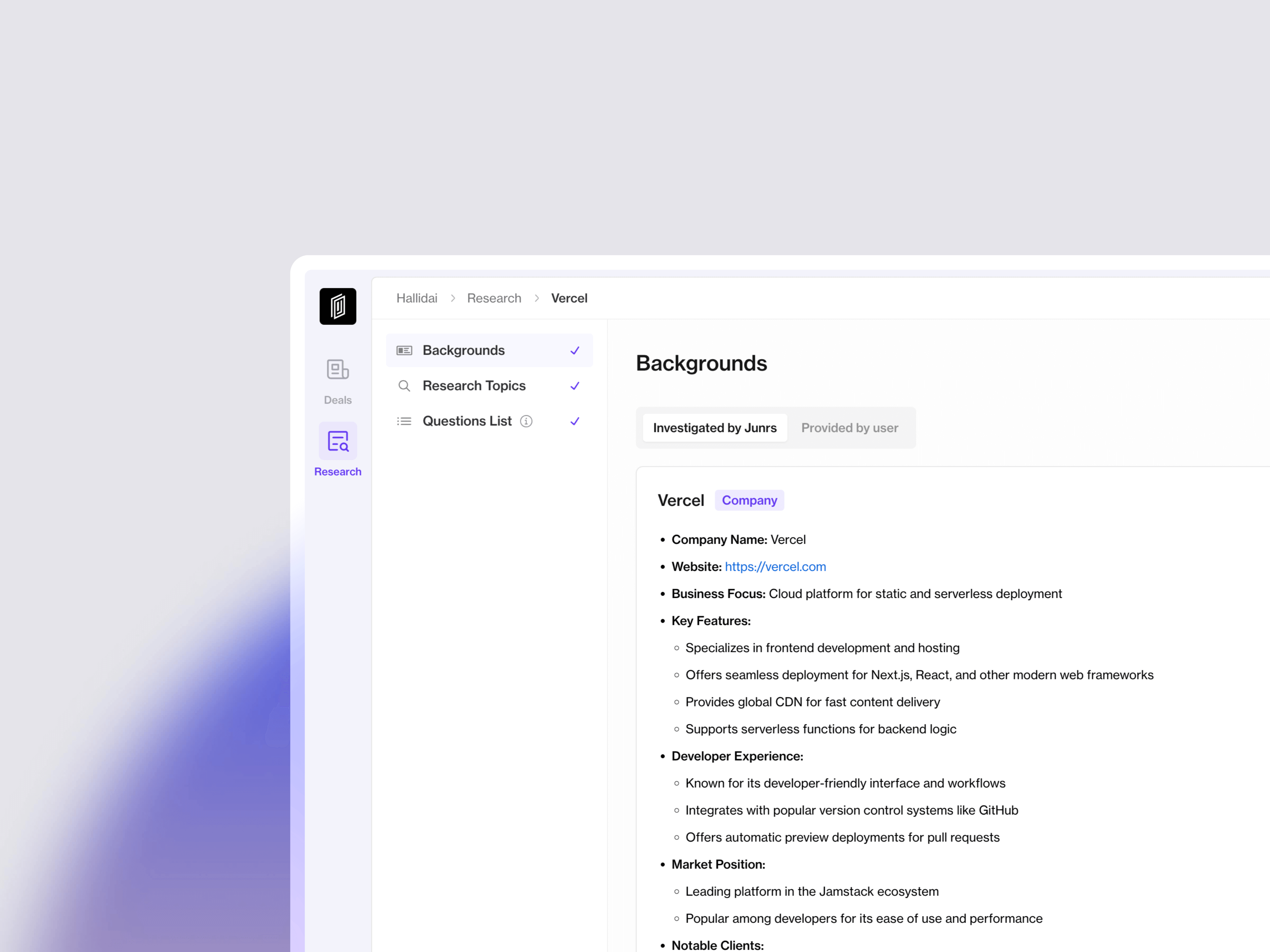

Key Point 3: AI-Enhanced Research Integration in Memos

In the fast-paced world of investment, staying ahead of the curve isn't just an advantage—it's a necessity. The sheer volume of data available today can be overwhelming, making it challenging to distill key insights into concise, actionable investment memos. This is where AI-enhanced research integration is revolutionizing the game, allowing investors to create more comprehensive and insightful memos with unprecedented efficiency.

Seamless Incorporation of Research Findings

Gone are the days of manually sifting through endless reports and market analyses. AI tools are now capable of automatically scanning vast databases of financial reports, news articles, and market trends, extracting relevant information, and seamlessly integrating it into your investment memos.

For instance, BlackRock, the world's largest asset manager, has been at the forefront of this revolution. Their Aladdin (Asset, Liability, Debt, and Derivative Investment Network) platform uses AI to analyze millions of data points daily, providing real-time insights that are automatically incorporated into investment recommendations and memos.

This AI-driven approach ensures that no crucial piece of information slips through the cracks. It can flag emerging market trends, potential risks, or opportunities that human analysts might overlook, enriching the quality of investment memos and, ultimately, decision-making processes.

Real-World Impact

The Hone Capital case further demonstrates the application and effectiveness of AI integrated research in actual investment environments.

In 2019, Hone Capital, a Silicon Valley-based VC firm, implemented an AI system to enhance their investment analysis process. The system, which they dubbed "Athena," was designed to automatically incorporate relevant research findings into their investment memos.

Athena scans thousands of data points, including company financials, market trends, social media sentiment, and even patent filings. It then synthesizes this information into coherent insights that are automatically integrated into the firm's investment memos.

The results were striking:

1. Time Efficiency: The time spent on creating comprehensive investment memos was reduced by 40%, allowing analysts to focus on higher-value tasks.

2. Improved Accuracy: Athena flagged potential risks and opportunities that human analysts had missed in 15% of cases, leading to more informed investment decisions.

3. Better Outcomes: In the year following Athena's implementation, Hone Capital saw a 22% increase in the success rate of their early-stage investments compared to the previous year.

4. Comprehensive Analysis: Investment memos now included a broader range of relevant data points, providing a more holistic view of potential investments.

Key Point 4: AI-Powered Memo Review and Optimization

In the high-stakes world of investment, the quality of your memos can make or break a deal. Enter AI-powered memo review and optimization – a game-changer for investors looking to sharpen their edge.

Imagine having a tireless assistant that can analyze your investment memos with laser-like precision, identifying structural weaknesses, content gaps, and areas for improvement. This is no longer a pipe dream, but a reality made possible by advanced AI systems.

Let's dive into how this technology is revolutionizing the way investment professionals craft and refine their memos:

1. Structural Analysis: Beyond Basic Proofreading

AI doesn't just catch typos; it evaluates the very architecture of your memo.

2. Content Completeness: Filling in the Gaps

In the fast-paced world of investments, it's easy to overlook crucial details. AI acts as a second set of eyes, identifying missing pieces of information that could make or break a deal.

3. Enhancing Clarity and Persuasiveness

Clear, compelling communication is at the heart of successful investment memos. AI tools are now capable of suggesting improvements to make your arguments more persuasive and your data more impactful.

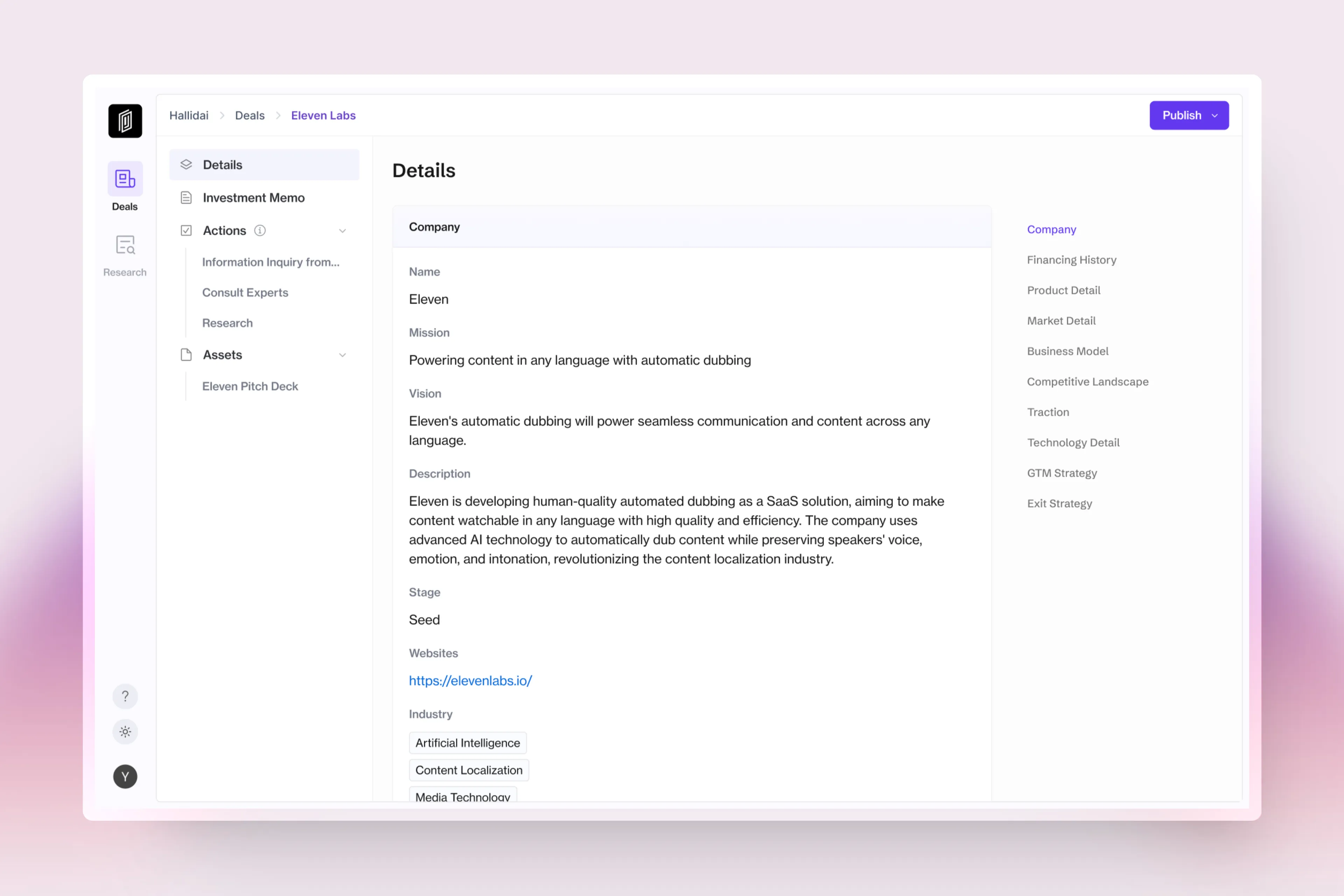

Implementing AI in Your Investment Process

As we've seen, AI tools can significantly enhance various aspects of the investment process. One such tool that has a role to play in the industry is Junrs, an AI application that aims to speed up deal flow management through its AI junior analyst capabilities. Junrs offers features that align with the methods we've discussed, including deal analysis, memo drafting, automated research, and meeting preparation.

When integrating AI tools like Junrs into your workflow, it's important to approach the process strategically. Start by identifying the areas where you face the most significant time constraints or challenges. This could be initial deal screening, memo creation, or meeting preparation. Implement the AI solution in these areas first to see immediate benefits.

It's also crucial to provide proper training to your team. While AI can significantly enhance efficiency, it's most effective when used in conjunction with human expertise. Encourage your team to view AI as a powerful assistant rather than a replacement for their skills and judgment.

Conclusion

The integration of AI into investment processes is not just a trend; it's a paradigm shift that's reshaping the industry. From automated deal analysis to AI-assisted memo drafting and enhanced research capabilities, these tools are enabling investors to work smarter, not harder.

As we look to the future, it's clear that AI will play an increasingly important role in investment management. The firms that embrace these technologies and successfully integrate them into their workflows will have a significant competitive advantage.

However, it's important to remember that AI is a tool, not a magic solution. The most successful investors will be those who can effectively combine the analytical power of AI with human intuition, experience, and relationship-building skills.